Blogs

My Experiences with Banks: An Introduction to Omni-Channel Customer Experiences

Durga Prasad

Posted On May 29, 2023

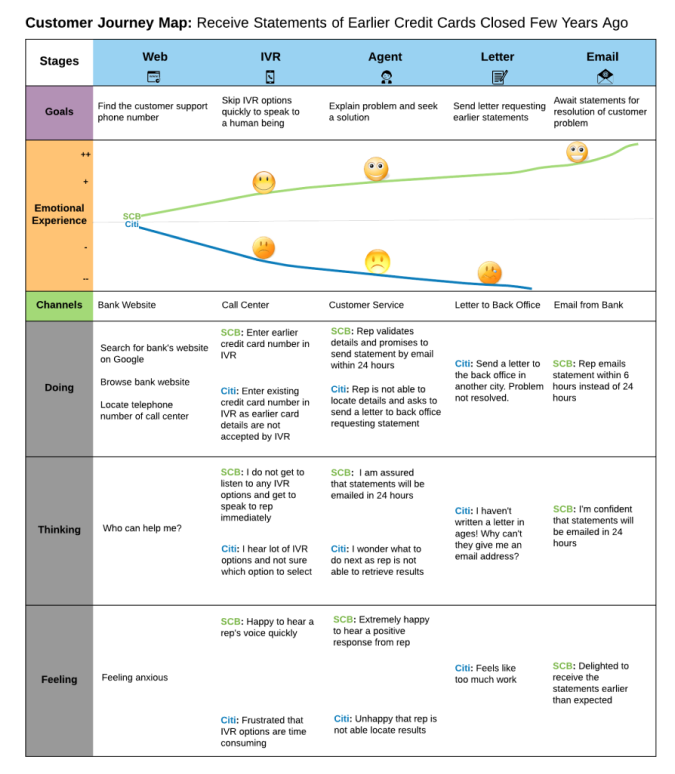

Recently, I had to reach out to two MNC banks for requesting past credit card statements for claiming a refund. This was complicated by the fact that I had cancelled these cards a while back.

In the case of Standard Chartered Bank (SCB), the experience was excellent and the interaction was smooth. Standard Chartered’s customer support representative was able to locate my cards details and sent me the statements within 6 hours much before the promised turnaround time of 24 hours. The experience with Citi on the other hand was below par and the customer support representative was unable to retrieve my card details and asked me to send a written request to their back office.

Being a UX professional, I couldn’t help taking a deeper look at my experiences and see what lessons could be learned by creating a customer journey map in order to identify gaps in the customer experience.

Interactive Voice Response (IVR)

- SCB – The IVR menu options were easy to understand and the system responded to my input in a predictable manner. The IVR recognised my earlier credit card number, concluded it was a cancelled card and immediately connected me to a human agent. With this contextual information, the rep was able to know about me before the call.

- Citi – The IVR menu started with an ad for a loan and the first menu option to speak to an rep immediately after the ad sounded like an option to speak to the rep specifically about the loan. This confused me and ended in me spending few minutes listening to other IVR options and finally selected the first menu option to speak to a rep.

Customer Support Representative Interactions

- SCB – The rep was courteous and the entire interaction involving my customer validation and searching for historical records was completed in 5 minutes. The credit card statements were emailed within 6 hours instead of 24 hours as promised by the rep. It was a delightful experience because it was quick, short and successful.

- Citi – The interactions with the rep were courteous. The rep was not able to assist me apart from asking me to send a letter to the back office. I was put on hold for few occasions and the call duration lasted closed to 15 minutes. I felt that the bank’s rep was not sensitive to request of sending by email as the card has been already closed and does not bring in revenues. I was unhappy with the bank’s customer experience.

Designing Seamless Experiences

Designing great customer experiences requires keen understanding of customer’s journey across different channels such as branches, website, mobile app, call center, etc. through visual storytelling tools such as customer journey maps.

In this case, the Standard Chartered experience was very good because it enabled seamless transitions across touchpoints for the customer. SCB proactively senses the context of a cancelled credit card and connects customer to the rep so that the issue can be handled quickly & appropriately. In the case of Citi, there is a break in the customer experience because IVR doesn’t provide relevant options for the owner of a cancelled credit card thus preventing progress.

An experienced CEO with a demonstrated history of creating a business in the design industry that delivers sustained growth, industry-leading profits through an unerring focus on customers & employees. With deep expertise in UX research across diverse sectors, he offer invaluable insights on customer-centricity and fostering success in business.